|

My father and uncles grew up in a time where prejudices were out in the open. My father witnessed violence towards Blacks growing up. Yet when their country asked them to serve they wore the uniform. My father would serve in the Army 10 years and was a Korean War Veteran. My uncle would serve in Vietnam surviving being shot down.

They did not wear the uniform to protect the violence nor prejudices. They wore the uniform because they believed in ideals such as "all men are created equal", "inalienable rights", "We the People" and "in order to form a more perfect union". And while my father served in uniform during the Korea War his parents had to pay a poll tax to vote in Texas. My dad left the military with a stronger sense of our nations ideals, who we really are, our responsibility to our brothers and sisters around the world, and what our democracy means to the world. These are the values my cousins and I grew up with. These are the values our veterans defend.

1 Comment

I could hear the small business owner on the phone as she was fighting back tears.....

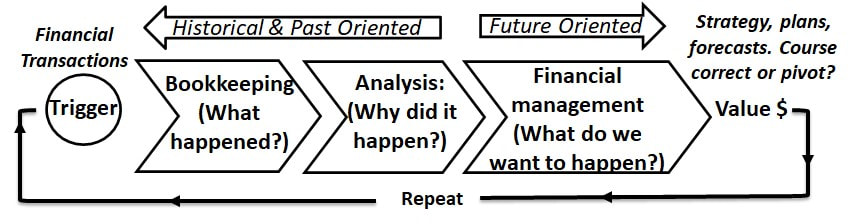

I have been speaking to small business owners across the US. They are all trying to get their 2019 data and submit for PPP. They need help and need it desperately. But it shouldn't be this way. Many of these small businesses do not have a financial system. I'm not talking about software, I'm talking about the fact that many small businesses are missing a financial management value stream. For years I have heard people in my community say you only need accounting software; it's more important to have a pitch; focus on marketing and branding, but this wrong. Current events show us that in addition to dazzling marketing you need a solid understanding and respect for finances and operations. What I have attached is the financial cycle of any enterprise. We need to build strong businesses and grow well rounded entrepreneurs. #smallbusiness #smallbusinessowner #startupnation #startupcommunity #entrepreneurs #financialmanagement #accounting #successfulbusiness The allure of the maverick

I watched Ford vs Ferrari recently. I recognized the leader who realized their firm had no future. I recognized the polished corporate "yes" people. I recognized the corporate enforcer of old ideas and old mindsets. In the midst of all that are two people who did not fit in. They shouldn't have been working with Ford. Yet they were necessary to break that stagnant thinking. A few times the characters would say things like "they are not Ford people" and "this is not the Ford way". This is the allure of the maverick. They are not constrained by group think, orthodox or culture. Companies want the benefits of a startup while maintaining the status quo, and you can't. I have spoken to employees who are are slowly dying inside because they know what needs to happen but are afraid of the impact to their careers or job. I have seen executives who want innovation and new ideas but don't want to let go of control. The allure of the maverick can be strong, but sometimes the corporate culture is stronger and becomes an environment where ideas and innovation die and eventually leads to the death of the corporation itself. #maverick #cultureoftransformation #innovation #newideas We will be celebrating the 240th year of our independence. 240 years ago, a small group decided to cut ties with a much larger and well established country. They wanted more autonomy and control. They also believed they could not only govern themselves, they would innovate and create a new system that the world had never seen before. Many would claim that the experiment of democracy and self rule in the new world would not work.

There are many parallels between the individuals who declared independence and those who start small businesses. The reasons are usually the same. The ideas, innovation and models are usually new, exotic and unique. Each brand is something that has never been seen. In the last few years we have been seeing a revolution that is being led by technology and technology firms. Once each business would need to invest substantial dollars in hardware when starting their business. But a concept came where a large collection of servers could house or host not just one businesses data but could house many businesses data. Soon concepts such as 'online', 'virtual', 'cloud', and 'social' started to take off. The technological barriers to starting a small business continue to fall. Platforms such as Weebly and Wix allow anyone to create their own websites merely by dragging and dropping already built components to create their own websites. Dropbox, Google Drive and now Microsoft OneDrive eliminate the need to have servers for your files and maintenance and backup are not something you need to worry about. Software is moving from CD's to online applications like Microsoft Office 365. Even accounting applications like Sage and QuickBooks are not just moving to online, but their abilities and functionality are continuing to improve and reach the ability of their desktop versions. What this means for small businesses is that they can now access technology and processing power that they could not afford before. They no longer have to invest and capitalize large sums of money, just pay the low monthly subscriptions. Even Amazon can allow someone to have an online store for starting at $40 a month. Our declaration and our revolution laid the ground work for other countries to move towards their own version of self rule and has shaped the world we live in. Technologies revolution will will no doubt shape our world and allow small businesses to compete on the same level as larger businesses. There is not doubt that technology will lead the business world but into what kind of future is not fully known. We wish everyone and their families a safe, and Happy Fourth of July and continue to pray for our brothers and sisters in uniform no matter where they are serving. As time passes new concepts will come up. There has been talk of data science recently. What is data science? It is the use of math, statistics, predictive analytics, data mining and other recognized methods to get insight from data. Some argue that data science is just a term for business analysis.

Our firm has merged this and technology with our financial/accounting to create a form of financial data science. We are not only trying to bring accounting and analysis into the 21st century but increase the value it can provide. Using data science allows us to see trends and give more of a forward view as opposed to the traditional historical view provided by accounting or bookkeeping. But how is data turned into insights? First we have to start with raw data. This is all data generated by day to day activity. Most systems have a database behind the scenes that keeps the raw data, the program merely presents that data in a format that is easy to read and understand. But even though the data resides in the table, it usually needs to be cleaned and tagged. How can data be dirty? Some software designers and programmers may not anticipate all analysis needs and may have a text box where different words or spellings may be entered by users. These may need to be cleaned and made uniform. Tagging the data may also be needed. If the system can extract data by location but does not add that piece of information, then attempting to analyze transactions by location will be impossible. Once data is cleaned and tagged, it can be analyzed. While there are many programs and applications that can be used to analyze data, using some of the features within the spreadsheet software like Excel can help to create consolidated tables, graphs or other analytical tools. Insights can be derived from historical activity and trends. These historical trends can then be used to help predict or forecast future events. For example businesses have seasonality in their annual activity. While the dollar amounts may rise or decline, they will follow a familiar pattern. These trends can be used to create budgets or financial forecasts. But understanding the data can also help in developing business models that allow you to see the impact of business decisions or changes to your business model to future financial results. Whether you believe data science is new or a rehash of an older concept, there is no question that it's application can help any business to make better informed business decisions. Better decisions means better outcomes and for small businesses this could mean a great deal. Thanks for your interest and we hope to continue to have meaningful conversations. When is something an anomaly and when is it the start of a trend? This is an important question in any business small or large. While some ask this in regards to fashions and customer demand this is an important question as it relates to your small businesses finances.

Being able to spot financial anomalies and trends requires the right reporting tools. There should be monthly reports that are reviewed, but having a sheet of numbers can be overwhelming to anyone. Plotting out financial data in graphs or bar charts with previous months information can help to better spot trends. Doing this can also help better understand the life of your business and help separate an issue from a seasonal trend. But when you do spot a change in the normal ebb and flow of your business how do you deal with it? This is where analysis comes into play. What caused the variance or change in trend? If it relates to revenue look at sales. Was there a change in the number of sales or was there a change in what items were sold? (more low dollar vs high dollar) If it relates to expenses, review which expense line items changed. Usually having a forecast of your expense dollars can help you better understand and manage your business expenses. If there are any variances review the assumptions that were made for the forecast with actual results. A vendor that has increased prices on their goods and services or a change in how you provide goods and services will be an ongoing change that should be reflected in forecasts of future months activities. This can help determine the year to date impact. Changes in sales can be harder to determine. Sales can depend on what drives your industry. If the impact to sales is a one time event you should see revenues return to a normal seasonal trend for your business next month. One might say that waiting two months to find out there is a problem is a bit too late. One of the best things you can do is review your sales and revenues weekly against last years to spot changes in trends before the end of the month. This can help in determining if you need more advertising or another action plan to help sales. If changes to sales are more permanent like a slow down in the local economy it is good to reduce your forecasted sales to have a realistic view of how your year could end up and the impact to the bottom line. Anomaly or trend? This is an important financial question that can help you better manage your small business and address issues before they become lingering problems. Thanks for your interest and we hope to continue to have meaningful conversations. Happy New Year and welcome to 2016! There has been a saying that the only constant in life is death and taxes, add change to that as well.

Things are changing and they are changing so fast. Technology was driving this change but now new ideas and innovations are adding to this change. But some of these changes are also putting a great deal of pressure on current industries. What are some of the changes that could dramatically change our world? Rise of the platform - startups are experimenting and refining systems such as holacracy and platforms. These are systems that allow small firms to manage their organization and empower front line employees without the need for layers of executive leaders or infrastructure like large corporations. Larger corporations are watching this closely and have identified these companies in their industry as a possible threat. Gig workforce/1099 workforce - small businesses can't afford to hire talent full time with benefits. With insurance exchanges through the ACA, and websites specifically designed for freelancers like Elance, Freelancer or Guru workers with skill sets can now become free agents instead of corporate employees. This allows small businesses to compete for talent by instead of offering regular paycheck and benefits offering challenging fulfilling projects that can grow skills while allowing the worker to have a sense of freedom. Sharing economy - ride share (Uber), AirBNB and other such platforms allow people to use their cars or an extra room to generate income. This puts pressure on the taxi and hotel industry, but it also changes how the average citizen contributes to the economy. Instead of exchanging labor in a corporate entity they exchange labor (driving) or space for income directly cutting out being an employee for the taxi or hotel industry. Digital money/democratic lending - Checks are slowing dying, cash is being replaced by the debit card but there are also experiments with digital money like Bitcoin or using technology for payment like Apple Pay or Samsung Pay. There are also platforms like Lending Club or Prosper with peer to peer lending. An individual can request a loan and when approved can be funded by peers like you and I with a minimum investment of $25. This cuts out financial institutions. The banking industry is also looking at these as possible threats. Automation - this is a big topic and concern. Technology and computers are not only getting faster but also have the ability to learn. There has been posts and thoughts on which jobs and industries could see the most impact. Self driving cars owned by Google or another company could also be huge by reducing the number of cars on the road, reducing the number of car owners, auto insurance policies, auto loans and oil changes. We can't stop progress, all we can do is understand it and figure out how we can fit into it and this ever changing future. Thanks for your interest and we hope to continue to have meaningful conversations. Five years, it doesn't seem like a long time. Five years into something means you have gotten past the initial start. For fifth wedding anniversaries the traditional gift is wood because wood symbolized strength and stability. But for small businesses five years means that they are part of the 50% who survived. For a small business that is up and running after five years there is another that did not make it.

Next month will be our firms fifth anniversary. We are part of the 50% who survived. Has it been easy, H-E double hockey sticks NO! It has taken a lot of work and a lot of growth. Have our plans or business model been modified over the five years, yes. Have we survived due to my awesome leadership, no. What has helped us is that we are a virtual accounting/CFO office to other small businesses. Our firm helps others run their business so we do for ourselves what we do for our clients. It is rare since for small businesses running their business is a different mindset and a second job to the services they provide to clients. While there are many blogs and online articles as to what small business owners have learned each appears to have learned different things. What have we learned in the last five years? 1) Don't forget to fly the plane - running a business is like flying a plane. There is a lot going on, if you narrowly focus on one warning light or one switch, you will not see the other warning lights and switches and you forget that you still have to fly the plane. You have to learn to be able to zero in on problems and issues but not lose sight of the big picture. 2) Plans can't be written in stone - You can write up your business plan and work out all of the details, but they can't be written in stone. In this day and age where things can change so quickly you have to be flexible and able to adopt to changes in your environment and industry or take advantage of new tools. 3) You will be stretched and challenged - I have learned a lot in the last five years and have learned skills that I could not have imagined having five years ago. I am still introverted as most financial/accounting people are but have had to learn the art of the elevator speech, call to action, building and growing a brand. 4) It's a sprint not a race - It's a long journey, there isn't a finish line and there isn't a race to reach ten years, fifteen years or any of the other anniversaries. 5) I would do it all over again - knowing what I know now, I would still do this. The work, the time, the challenges pale in comparison to what I have learned, how I have grown and what we have built and created. So after five years we can relax, right? No, based on data only 1/3 of all small businesses survive ten years out. We have to keep moving and keep doing the right things to keep going. Perhaps we will lucky enough to share what we have learned by our ten year anniversary. Thanks for your interest and we hope to continue to have meaningful conversations. How much is your businesses reputation worth? How much is the goodwill you have with your customers worth? While profit and loss are important and cash flow is the life blood of any business there are items that will never show up on your income statement or balance sheet.

Recently we learned that VolksWagen has been in the headlines due to a scandal involving their vehicles. The company has admitted to cheating on emission tests. But how could they cheat on a test performed by another entity or organization? While details are still not known, what has come to light is that the cars were programmed to 'know' when they were being tested and would change their operating mode to be able to pass the test. Once this mode is disabled the vehicle put out 40 times more pollutants than are allowed. This has been dubbed a 'cheat device' by some. This kind of engineering is not possible by one rogue engineer. Several individuals would have to be on board with this. Whether anyone at Volkswagen was concerned or dissented is unknown but it would seem that nothing prevented this engineering effort. Getting a good reputation takes time and trust, losing it takes only days or minutes. As of today, Volkswagen's CEO has resigned and the company is liable to pay fines or have to recall their vehicles which will affect their financial results. Customers who really believed their marketing about 'clean diesel' will look elsewhere for their next vehicle because customers would no longer see value in the brand, their reputation and will take their goodwill elsewhere. The Pope in his address to Congress said "Business is a noble vocation, directed to producing wealth and improving the world. It can be a fruitful source of prosperity for the area in which it operates, especially if it sees the creation of jobs as an essential part of its service to the common good". But perhaps in all the metrics, analysis, profit margin, shareholder value and revenue growth we have forgotten the one underlying truth in all business relationships, that it is based on human relationships. Human relationships are still based on trust. In business a set of beliefs, values and attitudes held collectively is the businesses culture. These can be set by leaders either by leading by example and/or rewarding behavior that is ethical or provides honest and excellent customer service. Continuously reinforcing this strengthens the culture. Employees see this is what is expected and trust that this is how to act. It's surprising how the most serious loss to Volkswagen isn't just money, but the assets that never showed up on their balance sheets. Thanks for your interest and we hope to continue to have meaningful conversations. This month the virtual assistant company Zirtual ceased operations overnight. Zirtual was not a small organization, it had raised $5 million and had 400 employees. The companies employees didn't know anything until they tried to log on their computers Monday morning. Clients only had a general communication that operations had 'paused'. There was no warning and it wasn't until the next day that the CEO posted a short communication out on social media indicating that the problem was burn rate or how much money it spends above what it makes. The CEO indicated that the company grew faster than they could handle due to converting from using contractors to having full time employees.

But blaming growth is not where the the problem was. The problem was that the company did not have the right financial tools, reporting or a financial plan to move forward and manage the growth. Spending more than you make as a business should show in your financial reports or cash flow reports. Zirtual should have seen monthly reports showing red at the end of the reports. Once there is a monthly trend of hemorrhaging cash, management should have jumped to action. But if your a small business or startup how do you manage this situation? What could Zirtual have done differently? First, there should have been a competent financial leader whether it is the CEO themselves or whoever is the designated financial executive. Secondly, for a startup there should have been financial projections to show where the company would be financially within the next six to twelve months with burn rate and how far current cash in bank could take the company (what month do you run out of cash). This should not have been a surprise, if the company was thinking of changing their business model a financial projection with the monetary impacts of the changes should have been put together and presented to the executive team. If this had happened the company could have developed a plan that would have allowed them to move forward and gradually change their business model. A quick analysis of customer requests and an average time to complete requests could have provided the company with an estimated number of employees needed and how much the payroll and tax obligation would be in the new business model. Instead Zirtual was either caught off guard, or the leadership team knew what was happening and didn't know what to do next. This highlights why both small companies and startups need to have a full understanding of their finances. While it's great to have the slick marketing, the social media, the great technology, without the right financial tools and knowledge all of that is worthless. What is left now are former employees looking to continue working for clients but as independent contractors. Startup.co has pledged to buy the assets and restart the company, but in what form no one knows yet. Having the right financial tools ensures that you understand the impact of major decisions or changes to your business models so that leaders can correct the course and continue to be the captains of their ships as opposed to leaving a sinking ship quietly while your crew sleeps in the middle of the night. Thanks for your interest and we hope to continue to have meaningful conversations. |

Archives

November 2020

Categories

All

|

RSS Feed

RSS Feed