|

I could hear the small business owner on the phone as she was fighting back tears.....

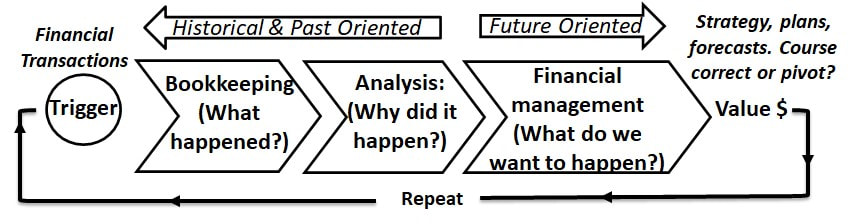

I have been speaking to small business owners across the US. They are all trying to get their 2019 data and submit for PPP. They need help and need it desperately. But it shouldn't be this way. Many of these small businesses do not have a financial system. I'm not talking about software, I'm talking about the fact that many small businesses are missing a financial management value stream. For years I have heard people in my community say you only need accounting software; it's more important to have a pitch; focus on marketing and branding, but this wrong. Current events show us that in addition to dazzling marketing you need a solid understanding and respect for finances and operations. What I have attached is the financial cycle of any enterprise. We need to build strong businesses and grow well rounded entrepreneurs. #smallbusiness #smallbusinessowner #startupnation #startupcommunity #entrepreneurs #financialmanagement #accounting #successfulbusiness

2 Comments

Sequestration, a long, funny sounding word with serious implications. With the deadline on March 1st and no resolution in site, there are predictions of dire consequences. Some small business contractors could be affected by reduced business with government agencies.

This is a reminder that challenges to our small businesses can come from anywhere and some may be out of our control. But how would a small business minimize the impact of outside forces? Diversification - it's always a good idea to have a diverse book of business. Providing different kinds of goods, or services in more than one market segment can help prevent catastrophic changes. Small businesses that only have government contracts may be in for a rough time. Cash on hand - it's good to have a reserve. Yes, sometimes it is very difficult to set up a reserve for your small business but you can use a budget to help build a reserve. Want to know how long you can operate on cash reserve only? Take the total cash you have and divide by your average total monthly cash outflow and multiply the result by 22 for the average number of workdays in the month. This will let you know how many days worth of reserve you have. ex. (Total cash on hand/Average monthly cash outflow) x 22=days worth of reserve Keep your customers informed - if the work you perform for your clients includes working with government or federal agencies let your clients know that services may take a little longer. Keeping your clients informed or resetting timelines will help with customer experience. Emergency reduction plan - do you have an emergency plan for your small business? Would you know which expenses are essential to your business and which you can cut or delay? Having a plan for surviving reduced work or business can help if a situation comes up. It would be no different than an exit plan in the event of a fire. You hope there will never be a fire, but you know what you need to do and where to go if there is one. Sometimes you will never know when a threat to your small business can come or where it can come from. But making sure your work is diversified, having a reserve and having a plan for such situations can help you and your small business survive challenging times. We hope that you had a festive and safe holiday season filled with family and friends. The season of peace and reflection now has given way to the start of a new year, new hope, and new opportunities. How can small business owners help themselves get off on to a good start for 2013? Here are a few tips: Budget - Have a realistic budget for your small business and stick to it. How do you go about creating a budget? You need good data and information to start with. Making sure that your business expenses are booked correctly helps. Don't fret if unexpected expenses such as a repair comes up during the year. These are one time events necessary to keep doing business. Get value for your dollars - when you look at your expenses, don't look to cut costs, look to see if there are opportunities to increase the value you get for the dollars you spend. Shop around and find what works for your small business. Remember customer experience matters - take care of the customer's needs first and make sure their experience is positive. Give your customers a reason to come back to you, think of you for other needs or recommend you to others. Stop, start and continue - Take some time to think about your business and make a list of things to stop, start and continue. Stop the things you are doing that are not working or is not providing value to your small business. Once you stop things that aren't working you will have some time to start things that you need to do for your small business. Also, continue the things that are working and are valuable to your small business. These are just a few tips to getting a small business off to a good start for 2013. So holidays have been celebrated and we are in the New Year. Now, it’s time to get back to work with your small business or micro business, But in what direction? This is where your budget comes into play. Hopefully your assumptions are directionally correct. But how do you measure how you are doing against your budget?

The way to measure is to have an actual to budget statement. This will allow you to see where you are compared to what you budgeted. A detailed statement with each account will help you focus in on the line items that are over budget. Now, do not assume that your small business spent when it shouldn’t. There needs to be some analysis of the transactions in the accounts that were over budget. Where these transactions necessary but out of the ordinary? These would be ok if they were unexpected but necessary expenses for your business such as a repair to a business vehicle or your office. Now if one of the business assumptions was incorrect this may cause the variance to the budget. If so this may carry out throughout the year. Sometimes what comes out of the analysis is that sometimes transactions were posted to the incorrect account and this may explain the discrepancy. But is there a way to know which direction you are going financially before the month is over and there is no chance to correct? One would have to be proactive and even implement certain financial processes to stay on track. One thing you can do is run your actual to budget financial statement mid month to see how close you are to your budgeted amounts. This may let you know that you are about to hit your budgets but do you still have a handle on your finances? The best way to get a good handle is to implement a purchase order system with a declining balance worksheet. You can use Excel to do this. Set up a template, enter your budgeted amount and with every purchase assign a purchase order, estimate the cost and reduce the balance. The benefit is that this allows for a control of purchases and allows you to see how much of your budget is left. When you have a tool like this it makes you more mindful of what you budgeted for these expenses and how your spending your small businesses money. Some additional processes that may also be beneficial are to have one point of contact that is responsible for the purchase of items such as materials, office supplies and any other business needs. Also designate one day per week or per month that you purchase items such as office supplies. That way you compile your lists of items to purchase and you can eliminate shipping costs either because you have a large purchase order or you only get charged for the limited times that items are shipped per month as opposed to every time you order a couple of items. These are some things that you can implement that can help you to stay in line with your budget and will help you better understand what is happening with your small business or micro enterprise. Most people don’t plan to fail, they fail to plan. – John L. Beckley

Have you or your business put together a budget for next year? For larger businesses the budget process is under full swing with meetings, analysis, calculations and submissions. Larger businesses and organizations have a formalized, mature budget process that they usually begin at the start of the fourth quarter or earlier in some cases. But what about smaller businesses? Some businesses do not put a budget together at all. But a budget is critical for a business, especially a small business. The first thing to realize is that budgets are your roadmap for the coming year. No one has to have a crystal ball or needs to be psychic and budgets are not chiseled in stone. If you have a good understanding of your business and industry you can put together a good budget. Beyond having a template to enter numbers, how do you build a budget? You can estimate a number and enter it every month but this may not help you build an accurate budget. Also, how do you measure the success of your budgeting? Is your business going in the right direction? The first thing you need to do is ask where you want your business to be in five years. It does not have to be specific or detailed. This will help you frame your budget for the following year. Think of your budget as the first steps in a five year journey. Next, there are expenses that are consistent and will never change or fluctuate with business activity such as non-business utilities, membership renewals, rent or leases. These are your fixed costs. Keep in mind that some costs will fluctuate. For example here in south Texas we know that our electricity costs increase in the summer because we will use our ac more due to the high summer heat. Businesses in the north may want to adjust for fuel for the winter in the same fashion. Also make sure to exclude any one time costs that were out of the ordinary that you will not see in the next year. Some budgets are built off of last year’s numbers and sometimes include onetime costs. Next item is to look at your variable costs. These are costs that are impacted by business activity. One of the best ways is to forecast sales volumes and multiply by the costs of producing/providing the goods or services. The quickest way to calculate this is take the cost divided by products produced or services provided. You may want to make this calculation for each month of the current year to see if there were any trends. Your production costs may have increased during the year and you would be using an average as opposed to the new production cost. If you perform this calculation during the year you will know this number beforehand and will help you to be proactive in addressing costs. Now you may feel unsure about forecasting your sales volumes. What you can do is look at the previous three years, is there some seasonality in your numbers? In other words, are there months where you do more business than others? Some businesses provide goods or services that are in demand in the summer and others see their demand during the holidays. If volume growth has been small you may be able to take the current years volumes and add the average increase in your year over year activity. If not take your current years volumes and enter them. You can then take the volumes and multiply them by the costs to provide the good or service, for example, this task requires so many hours from my employees at this pay. The best part about forecasting out volumes is now this will drive your sales revenue numbers. It is best to break out products or service volumes and apply the dollar figures item to provide a more accurate budget number, for example, dollars for product a times volumes for product a, and then the same methodology for product b. Trying to create one sales revenue budget number may not be accurate and may skew your budget.The next step is to review any projects or improvements you may make during the year. Large businesses usually have initiatives for either streamlining processes or carrying out major marketing initiatives or any other major project. Large businesses will usually calculate the impact and adjust their budgets accordingly. You may not carry out any major projects but if you know that in the coming year that you will purchase tools and equipment that will make work easier or allow for more products to be produced you need to adjust your budget for this. Also, if you know you want to market your business in the following year get a reasonable estimate and add it to the month or months that you will market for both the expense and the increase in sales volumes. Here historical costs based on previous efforts are helpful. Even though this may be difficult to know the impact (if any) but just be conservative in your expectations. The items above are, at a high level, some of the most important things to keep in mind when developing your budget. Again, this will not be held against you, as long as you know what the variances are due and realizing that some variances will carry out through the year.Next blog: How do you measure the success of your budgeting? |

Archives

November 2020

Categories

All

|

RSS Feed

RSS Feed